Metropolitan Stock Exchange Unlisted Shares

METROPOLITAN STOCK EXCHANGE

METROPOLITAN STOCK EXCHANGE

Metropolitan Stock Exchange of India Limited (MSE) is appreciate by Securities and Exchange Board of India (SEBI) under Section 4 of Securities Contracts (Regulation) Act, 1956. The Exchange was notice as a “recognized stock exchange” under Section 2(39) of the Companies Act, 1956 by Ministry of Corporate Affairs, Govt. of India, on December 21, 2012.

For your kind information Shareholders of the Exchange include India’s top public sector banks, private sector banks and domestic financial institutions who, together hold over 88% stake in the Exchange. MSE is apply to CAG Audit and has an independent professional management.

Best practices and regulatory essential, clearing and settlement of trades done on the Exchange are conducted through a separate clearing corporation − Metropolitan Clearing Corporation of India Ltd.

Metropolitan Stock Exchange (MSEI) Unlisted Shares:

- Metropolitan stock exchange shares buy sell

- Buy Metropolitan stock exchange shares

- Sell Metropolitan stock exchange shares

- Shares of Metropolitan stock exchange

- Buy MSE shares

- Sell Shares of MSE

- Shares of MSE

Metropolitan Stock Exchange of India Limited (MSEI) is a full-service national level Stock Exchange with a license to operate in Equity, Equity Derivatives, Currency Derivatives, Debt and SME Platform.

It has a live trading platform in all segments except SME. MSEIL has two subsidiaries: Metropolitan Clearing Corporation of India Limited (MCCIL) and MCX SX KYC Registration Agency Limited (MRAL) in which it holds 86.94 and 100 percent. MCCIL is in the business of clearing and settlement of deals in multi-asset classes carried out at MSEIL and MRAL is in the business of maintaining a database for members of the exchange and other under the Know Your Client (KYC) Guidelines.

Key Highlights

(i) The ownership of MSEIL is diversified between corporates, banks and individuals.

(ii) The shareholding of MSEIL consists of Banks/Flls at 23.64% which includes leading public and private sector banks like State Bank of India, Bank of Baroda, Punjab National Bank, Axis Bank, HDFC Bank, etc.

(iii) Leading Corporates and institutions hold around 29.94% which includes Edelweiss Commodities Services Limited, IL&FS Financial Services Limited, Multi Commodity Exchange of India Limited, etc.

(iv) Individual Investors hold around 40.47% which includes leading investors like Mr. Rakesh Jhunjhunwala, Mr. Radhakishan Damani, Mr. Nemish Shah among others.

Metropolitan Stock Exchange (MSEI) Unlisted Shares Details:

| Total Available Shares: | 1000000 |

| Face Value: | ₹ 1 Per Equity Share |

| ISIN: | INE312K01010 |

| Lot Size: | 10000 Shares |

| Current Unlisted Share Price: | ₹ Best in industry Per Equity Share |

| Retail Discount: | Bulk Deal (5%) |

Promoters And Management:

Promoters and Director of Metropolitan Stock Exchange (MSEI) Unlisted Shares Company are:

| NAME | DESIGNATION |

| Mr. Udai Kumar |

Managing Director & CEO |

| Prof. Ashima Goya | Chairperson & Public Interest Director |

| Mr. D. G. Patwardhan | Public Interest Director |

| Mr. D. K. Mehrotra | Public Interest Director |

| Mr. Ajai Kumar | Public Interest Director |

| Mr. Ketan Vikamsey | Public Interest Director |

Shareholding Pattern:

Top 10 Shareholders of MSEI as on 31.03.2019

| Sr.no | Name of the Shareholder | No.of Shares | %age |

| 1 | Multi Commodity Exchange of India | 33,17,77,008 | 6.90% |

| 2 | Siddharth Balachandran | 23,84,09,950 | 4.96% |

| 3 | RADHAKISHAN S Damani | 11,93,63,496 | 2.48% |

| 4 | TRUST INVESTMENT Advisors private Limited | 11,91,15,930 | 2.48% |

| 5 | IL AND FS FINANCIAL SERVICES LIMITED |

119,109,627 | 2.48% |

| 6 | UNION BANK OF India | 10,87,50,000 | 2.26% |

| 7 | STATE BANK OF India | 9,74,00,000 | 2.02% |

| 8 | NEMISH S SHAH | 9,73,70,000 | 2.02% |

| 9 | AADI FINANCIAL Advisors LLP | 9,73,50,000 | 2.02% |

| 10 | KUMAR CHIMANLAL MEHTA | 8,87,54,112 | 1.85% |

Financials of Metropolitan Stock Exchange (MSEI) Unlisted Shares:

| Consolidated Financial Performance | ||||

| Particulars (Rs. In Lakhs) | 2015-16 | 2016-17 | 2017-18 | 2018-19 |

| Total Revenue | 3200.64 | 3638.37 | 2828.06 | 3520 |

| Profit/Loss Before Tax (PBT) | -4005.34 | -3258.25 | -5476.3 | -3845 |

| Profit/Loss After Tax (PAT) | -4005.34 | -3258.25 | -5474.85 | -4059 |

| Earnings per share (EPS) | -0.16 | -0.15 | -0.15 | -0.08 |

Other Highlights |

|

|

Particulars (Rs.In Cr) |

Year-2019 |

|

Equity Capital |

480.52 |

|

Net Worth |

371.07 |

|

Book Value Per Share |

0.77 |

|

Face Value (In Rs.) |

1 |

Review of Consolidated Financials Of MSEI For FY18-19

(i) The MSEI has seen a Revenue jump of 25% in FY18-19 as compared to last year. The jump mainly due to ” other income”. The Trading income remains flat at 8.04 Cr.

(ii) The MSEI has incurred losses of Rs.40 Crore in FY18-19, the losses reduced by ~14 Crore, as compared to the previous year’s loss of Rs.54 Crore. The losses have been curtailed due to a reduction in “Advertisement & business promotion expenses “.

(iii) The EPS for FY18-19 stands at -0.08 an increase of 100%. Last year it was -0.15.

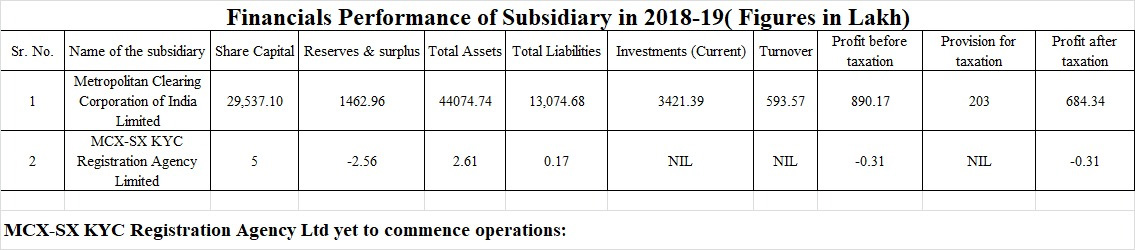

(iv) Financials of MSEI Subsidiary in 2018-19.

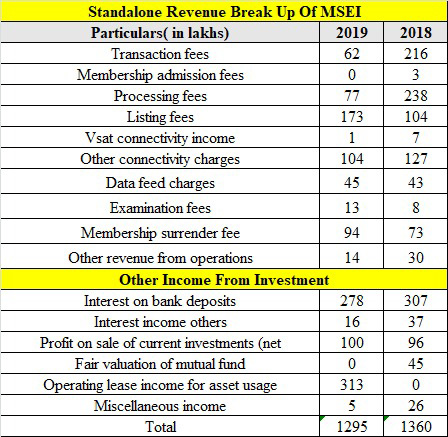

(v) Revenue break-up of MSEI on a Standalone basis. This bifurcation is being done to know, how the company is earning revenue from different products.

Company Address:

Metropolitan Stock Exchange of India Limited,

Vibgyor Towers, 4th floor, Plot No C 62, G – Block, Opp.

Trident Hotel, Bandra Kurla Complex, Bandra (E),

Mumbai – 400 098, India.

phone No. +91 22 6112 9000

Website: www.msei.in

Buy shares of Chennai Super Kings Buy Shares of ONE97 COMMUNICATIONS Buy shares of Hdb financial services Buy shares of Bharat Nidhi ltd Buy shares of Paytm Buy Shares of Indofil industries ltd

METROPOLITAN STOCK EXCHANGE OF INDIA LIMITED UNLISTED SHARE

ABOUT MSEI

METROPOLITAN STOCK EXCHANGE OF INDIA LIMITED is a national-level stock exchange operating in Equity, Equity Derivatives, Currency Derivatives, debt, and SME segments. The Exchange ecosystem supports various intermediaries’ including stockbrokers, authorized persons, corporates, banks, depositories, depository participants, custodians and investors. The exchange offers an electronic, hi-tech, and transparent platform for trading in capital markets, futures and options, debt markets, and currency derivatives segments. However, the Exchange has temporarily suspended trading in its debt segment from September 2020.

Metropolitan Stock Exchange of India Limited comprises 2 indices. SX40 and SXBANK. SX 40 consists of 40 large-cap liquid stocks representing different sectors. SXBANK measures the performance of the banking sector. The index consists of 10 stocks from the banking sector.

MSE offers a variety of products and services across multiple asset classes in India which enables it to be responsive to market demands. It’s state-of-the-art technology and robust network is a pioneer in technology and ensures the reliability and performance of its systems. MSE’s products and services foster digital transformation in technology, cyber security, innovation, and intelligence solutions. Products offered by the exchange across various segments to Proprietary, Retail Participants, and Institutional Participants (Domestic and Foreign include Current Future and Options, Cross currency futures & options, interest rate futures, equity shares, sovereign gold bonds, ETFs, offer for sale, stock futures & options, Index futures & options.

As of 31st March 2020, the exchange has 558 members for its currency derivatives segment, 346 members for the equity cash segment, and 334 equity futures & options segment.

INCORPORATION DETAILS

| CIN | U65999MH2008PLC185856 |

| Registration Date | 14 August 2008 |

| Category/Sub-category of the Company | Company Limited by Shares |

| Address of the Registered office and contact details | Vibgyor Towers, 4th Floor, Plot no. C-62, G Block

BandraKurla Complex, Bandra (East), Mumbai- 400098. Tel No: 022 61129000 Email Id: secretarial@msei.in |

| Name, Address and Contact Details of

Registrar and Transfer Agent, if any |

KFin Technologies Private Limited

Selenium Tower B, Plot numbers 31 & 32 Nanakramguda, Financial District, Gachibowli Hyderabad – 500 032 Email: einward.ris@kfintech.com Tel.No.: +91-040-6716 2222 |

PRINCIPAL BUSINESS ACTIVITIES OF THE COMPANY

| Name and Description of main products/services | NIC Code of the product/service | % to total turnover of the Company |

| Exchange Operation | 66110 | 100% |

BOARD OF DIRECTORS

Mr. Dinesh Kumar Mehrotra (Chairman & Public Interest Director)

Mr. Ajai Kumar (Public Interest Director)

Mr. SudhirBassi (Shareholder Director)

Ms. Latika S. Kundu (Managing Director & CEO)

Ms. TrishnaGuha (Public Interest Director)

Mr. S.V.D Nageswara Rao (Public Interest Director)

Mr. Vijay Sardana (Public Interest Director)

PARTICULARS OF SUBSIDIARY COMPANIES

| Name of the Company | % of shares held |

| Metropolitan Clearing Corporation of India Limited | 95.85% |

| MCX SX KYC Registration Agency Limited | 100.00% |

METROPOLITAN STOCK EXCHANGE OF INDIA LIMITED UNLISTED SHARE DETAILS

| Total Available Shares: | 4,81,02,17,033 |

| Face Value: | Rs. 1 Per Equity Share |

| ISIN: | INE312K01010 |

| Pan No. | AAFCM6942F |

| Last Traded Price: | Rs.1.15 |

| Lot Size: | 10000 Shares |

| Current Unlisted Share Price: | Rs.553.17 Crore |

SHAREHOLDING PATTERN

(As of 31-03-2020)

| S. No. | Shareholders’ Name | Number of shares | % of total Shares of the company |

| 1 | MULTI COMMODITY EXCHANGE | 33,17,77,008 | 6.90% |

| 2 | SIDDHARTH BALACHANDRAN | 23,84,09,950 | 4.96% |

| 3 | RADHAKISHAN S DAMANI | 11,93,63,496 | 2.48% |

| 4 | BANK OF BARODA | 9,37,57,564 | 1.95% |

| 5 | STATE BANK OF INDIA | 9,74,00,000 | 2.02% |

| 6 | OTHERS | 3,92,95,09,015 | 81.69% |

| Total | 4,81,02,17,033 | 100.00% |

INDUSTRY OUTLOOK

The Indian stock market exchanges are important market infrastructure intermediaries and they are guided by the Securities and Exchange Board of India (SEBI). They work as a tool for nation building and a major job creator. The Exchanges comprise of many asset classes – equities, equity derivatives, currency derivatives, government and corporate bonds, interest rate derivatives, commodity derivatives, etc. Stock exchanges in India are primarily regulated by SEBI. SEBI has introduced the interoperability between Clearing Corporations, the framework is applicable to all the recognized CCPs excluding those operating in the IFSC zone, and all the products available for trading on the stock exchanges (except commodity derivatives), interoperability norms benefit market participants to rationalize margins across exchanges and products by optimizing the use of capital but also reduce post-trade costs of trading firms.

With a favorable regulatory environment, Indian capital markets are expected to remain attractive to both domestic and foreign investors. Initiatives by the government towards ease of doing business enhanced sectoral caps, and simpler mechanism to obtain approval for investment coupled with tax exemptions is expected to further boost the robust business environment for foreign investors leading to a larger inflow of capital in the coming years as well. This will not only augment the depth, maturity, and robustness of the Indian capital markets but also build investor confidence.

In a population of about 1.37 billion people, only around 2.5% invest in the capital markets in India. India has nearly 4 crore demat accounts, out of which only 0.95 crore is active. Traditionally, metropolitan cities have played an important role in contributing to the markets but it has been mostly restricted up to that point. There is still a significant dearth of participation from Tier II and Tier-IIIcities, which would be the main contributor to the booming markets across all socioeconomic strata. The entry of young investors from this small town would be pivotal for driving the next level of growth in Indian Capital Markets. Metropolitan Stock Exchange of India Limited aims at catering to this need of the hour through easily accessible customized products across multiple investment avenues.

METROPOLITAN STOCK EXCHANGE OF INDIA Limited Balance Sheet (In Rs. Lakhs)

| PARTICULAR | 31-Mar-23 | 31-Mar-22 | 31-Mar-21 |

| ASSETS | |||

| Non-Current Assets | |||

| Property, plant and equpment | 634 | 891 | 865 |

| intangble assets | 781 | 1,534 | 1,879 |

| intangble assets under development | 39 | 176 | 260 |

| Right of use assets | 287 | 744 | 1,015 |

| Financial assets | |||

| Investments | 437 | 2,823 | 891 |

| Other financial assets | 902 | 1,324 | 620 |

| Income tax assets (net) | 342 | 418 | 372 |

| Deferred tax assets (net) | – | 186 | 186 |

| Other non-current assets | 4,904 | 4,896 | 4,601 |

| Total Non-Current Assets | 8,326 | 12,992 | 10,689 |

| Current Assets | |||

| Investments | 6,909 | 5,269 | 6,499 |

| Trade receivables | 91 | 421 | 160 |

| Cash and cash equivalents | 721 | 1,482 | 189 |

| Bank balance other than above | 10,639 | 21,602 | 24,604 |

| Other financial assets | 1,365 | 1,818 | 5,363 |

| income tax assets (net) | 1,441 | 1,048 | 1,167 |

| Other current assets | 454 | 465 | 486 |

| Total Current Assets | 21,620 | 32,105 | 38,468 |

| Total Assets | 29,946 | 45,097 | 49,157 |

| EQUITY AND LIABILITES | |||

| Equity Share capital | 48,052 | 48,052 | 48,052 |

| Other eqiuty | -23,897 | -21,984 | -18,877 |

| Total Eqiuty | 24,155 | 26,068 | 29,175 |

| Non Controllng nterest | 514 | 525 | 553 |

| Core Settlement Guarantee Fund | – | 850 | 865 |

| LIABILITIES | |||

| Non-Current Liabilities | |||

| Lease rental liability | 142 | 569 | 822 |

| Other financal liabilites | 2,060 | 11,899 | 11,506 |

| Provisons | 23 | 29 | 39 |

| Deferred Tax Liability | – | 127 | 96 |

| Total Non-Current Labltes | 2,225 | 12,624 | 12,463 |

| Current Liabilites | |||

| Lease rental liability | 216 | 265 | 249 |

| Trade payables | |||

| Total outstanding dues of micro, small and medum enterprises | 2 | 0 | 1 |

| Total outstanding dues to creditors other than micro, small and medium enterprises | 90 | 58 | 134 |

| Other financial liabilites | 1,979 | 3,989 | 4,865 |

| Other current liabilites | 742 | 697 | 834 |

| Provsions | 23 | 21 | 17 |

| Total Current Liabilites | 3,052 | 5,030 | 6,101 |

| Total Equity and Liabilities | 29,946 | 45,097 | 49,157 |

METROPOLITAN STOCK EXCHANGE OF INDIA Limited Profit & Loss Statement (In Rs. Lakhs)

| PARTICULAR | 31-Mar-23 | 31-Mar-22 | 31-Mar-21 |

| Income | |||

| Revenue from operations | 922 | 1,006 | 1,063 |

| Other income | 4544 | 1,500 | 2,182 |

| Total Income | 5466 | 2,506 | 3,245 |

| EXPENSE | |||

| Operating expenses | 2324 | 1,730 | 1,695 |

| Employee benefits expense | 1897 | 1,985 | 2,290 |

| Finance costs | 39 | 60 | 83 |

| Advertisement and business promotion expenses | 379 | 58 | 59 |

| Depreciation and amortisation expense 3 & 4 | 794 | 777 | 723 |

| Depreciation On Right to Use Assets | 271 | 271 | 394 |

| Other expenses | 1234 | 751 | 1,068 |

| Total Expenses | 6938 | 5,632 | 6,312 |

| Loss before Exceptional items and tax | -1472 | -3,126 | -3,067 |

| Exceptional items | |||

| Software written off | 521 | – | – |

| Loss before tax | -1993 | -3,126 | -3,067 |

| Tax expense | |||

| Less : Current tax | – | 14 | – |

| Less : Earlier year tax | – | – | – |

| Less : Deferred tax | -127 | 27 | 41 |

| Loss for the year | -1866 | -3,167 | -3,108 |

| Non Controlling Interest | -11 | -33 | -26 |

| Other comprehensive income | |||

| Items that will not reclassified to profit or (loss) (net of tax) | 27 | 36 | 11 |

| Income tax relating to item will not reclassified to profit or ( loss ) | – | -4 | – |

| Total other Comprehensive Income for the year, net of tax | 27 | 32 | 11 |

| Total Comprehensive Income for the year | -1828 | -3,102 | -3,070 |

| Earnings per equity share of face value of Re.1 each | |||

| Basic (in Rs.) | -0.04 | -0.06 | 0 |

| Diluted (in Rs.) | -0.04 | -0.06 | 0 |

METROPOLITAN STOCK EXCHANGE OF INDIA Limited Consolidated Cash Flow Statement (In Rs. Lakhs)

| PARTICULAR | 31-Mar-23 | 31-Mar-22 | 31-Mar-21 |

| A. Cash flow from Operating Activities | |||

| Net Profit / (Loss) before tax as per Statement of Profit and Loss | -1,866 | -3,167 | -3,107 |

| Adjustments for | |||

| Depreciation/Amortisation | 794 | 777 | 723 |

| Depreciation On Right to Use Assets | 271 | 271 | 394 |

| Assets Written ott | 521 | – | – |

| Net fair value gain/loss on financial assets measured at fair value through profit and loss | -29 | -36 | -31 |

| Exchange Rate fluctuation | -1 | 1 | -1 |

| Interest income from financial assets at amortised cost | -2,815 | -1,314 | – |

| Discount income on bonds | -4 | – | – |

| Interest on IT Refund | -24 | -8 | -67 |

| Refund of Core SGF Contribution | -1,546 | – | – |

| Finance Costs – ROU Asset (net) & Write ott Income | 39 | 60 | 24 |

| Profit on sale of Property, plant and equipment (net) | -2 | -1 | 0 |

| Provision for doubtful debts | 10 | 35 | |

| Profit on sale of investments (net) | -58 | -47 | -76 |

| Property, plant and equipment / CWIP written ott / provided for | 136 | – | |

| MAT Credit written ott | 186 | – | |

| Sundry balances written back | -20 | -79 | – |

| Remeasurement of Employee Benefit | 27 | 32 | 11 |

| -2,515 | -309 | -716 | |

| Operating profit/ (loss) before working capital changes | -4,381 | -3,476 | -3,824 |

| Adjustments for | |||

| Decrease/ (increase) in trade receivable | 341 | -217 | -82 |

| Decrease/ (increase) in financial & other assets | -40 | -245 | -388 |

| Total Increase / (decrease) in Current and non current assets | 301 | -462 | -470 |

| Increase / (decrease) in trade payables | 34 | -77 | 14 |

| Increase / (decrease) in financial & other liabilities | -12,862 | -523 | -17 |

| Increase / (decrease) in provision | -8 | -2 | -33 |

| Total Increase / (decrease) in Current and non current Liabilities | -12,836 | -602 | -36 |

| Cash generated from/(used in) operations | -16,916 | -4,540 | -4,329 |

| Less:( Taxes paid) / refund received | -294 | 81 | 538 |

| Net cash generated from/(used in) operating activities | -17,210 | -4,459 | -3,791 |

| B. Cash flow from investing activities | |||

| Purchase of Property, plant and equipment (including Capital Work In Progress) | -306 | -454 | -699 |

| Proceeds from Property, plant and equipment (net) | 2 | 3 | 2 |

| Purchase of current investments | -5,197 | -4,956 | -33,454 |

| Proceeds from sale of current investments | 6,087 | 5,823 | 36,817 |

| Fixed deposit placed with banks | -13,326 | -24,893 | -28,163 |

| Corporate Deposits ( net ) | 1,395 | -1,568 | -1,278 |

| Refund of Core SGF Contribution | 1,546 | – | |

| Fixed deposit matured | 25,316 | 30,777 | 28,022 |

| Investment in Corporate Bonds (Including premium) | -1,539 | – | |

| Profit on sale of investments (net) | 87 | 84 | 108 |

| Interest received (net of accrued interest) | 2,711 | 1,234 | 1,768 |

| Net cash generated from/(used in) Investing Activities | 16,776 | 6,050 | 3,122 |

| C. Cash flow from financing activities | |||

| Lease Liability Payment | -328 | -298 | -438 |

| Net cash generated from/(used in) Financing Activities | -328 | -298 | -438 |

| Net Increase in Cash and Cash Equivalents | -762 | 1,293 | -1,107 |

| Cash and Cash Equivalents at Beginning of the Year | 1,482 | 189 | 1,297 |

| Cash and Cash Equivalents at End of the Year | 720 | 1,482 | 189 |

| Add : Fixed Deposits held for more than three months | 10,639 | 21,602 | 24,604 |

| Closing Cash and Bank Balance | 11,359 | 23,084 | 24,793 |

| Component of cash & bank balance | |||

| In current account | |||

| Owned | 241 | 727 | 135 |

| Earmarked | 479 | 755 | 54 |

| Cash on hand | – | – | – |

| Stamps in hand | – | – | – |

| Balances as per statement of cash flows | 720 | 1,482 | 189 |

Let ‘s break down the Cash Flow Statement for the years 2023, 2022, and 2021, activity-wise:

For the Year Ended 31-Mar-23:

Operating Activities: The company reported a net cash outflow from operating activities at -17,210 million rupees. This negative cash flow primarily resulted from adjustments like depreciation, exchange rate fluctuations, interest income, and various provisions. The operating profit before working capital changes was -4,381 million rupees.

Investing Activities: The net cash generated from investing activities was positive at 16,776 million rupees. Key contributors were proceeds from the sale of current investments, fixed deposit maturity, and interest received. This reflects a strategic and positive investment stance during the year.

Financing Activities: In financing activities, there was a net cash outflow of -328 million rupees, mainly due to lease liability payments. This indicates the company ‘s commitment to meeting its financial obligations.

Overall: The company experienced a decrease in cash and cash equivalents by -762 million rupees during the year, ending with a closing balance of 11,359 million rupees.

For the Year Ended 31-Mar-22:

Operating Activities: The net cash outflow from operating activities was -4,459 million rupees. Despite a negative cash flow, this represents an improvement compared to the previous year. Operating profit before working capital changes stood at -3,476 million rupees.

Investing Activities: The net cash generated from investing activities was positive at 6,050 million rupees. This positive trend was driven by proceeds from the sale of current investments and fixed deposit maturity.

Financing Activities: In financing activities, there was a net cash outflow of -298 million rupees, reflecting lease liability payments.

Overall: The company ended the year with a net increase in cash and cash equivalents of 1,293 million rupees, resulting in a closing balance of 23,084 million rupees.

For the Year Ended 31-Mar-21:

Operating Activities: The net cash outflow from operating activities was -3,791 million rupees. This was primarily influenced by various adjustments such as depreciation, exchange rate fluctuations, and interest income.

Investing Activities: The net cash generated from investing activities was positive at 3,122 million rupees. Key contributors were proceeds from the sale of current investments, fixed deposit maturity, and interest received.

Financing Activities: In financing activities, there was a net cash outflow of -438 million rupees, mainly due to lease liability payments.

Overall: The company experienced a decrease in cash and cash equivalents by -1,107 million rupees during the year, ending with a closing balance of 24,793 million rupees.