More than seventy small-cap stocks conclude the day with double-digit returns.

The market posted moderate gains in another volatile week that ended on June 9, amid mixed cues including a policy outcome consistent with RBI’s cautious stance on inflation, less participation by foreign investors, and a surprising rate hike by Australia’s and Canada’s central banks that caused uncertainty about the upcoming meeting of the US Federal Reserve the following week.

BSE Sensex increased by 78.52 points to close at 62,625.63, while Nifty50 rose by 29.3 points to 18,564.40.

This week, the BSE Large-cap index finished unchanged, the BSE Mid-cap index gained nearly 1 percent, and the BSE Small-cap index rose 1.6%.

RBI Policy

As anticipated, the Monetary Policy Committee (MPC) of the Reserve Bank of India maintained the repo rate, the primary short-term lending rate, at 6.5 percent and maintained the “withdrawal-of-accommodation” stance.

The central bank maintained its GDP growth forecast for fiscal year 2023-24 at 6.5 percent while revising its inflation forecast for fiscal year 2023-24 slightly downward by 10 basis points to 5.1%, but still above its target of 4%.

The inflation forecast for 2023-24 has been reduced by 10 basis points to 5.1 percent.

“The domestic market started the week on a positive note, bolstered by favourable indicators such as stronger-than-expected PMI figures, sequential growth in auto sales, and robust growth in bank credit. These factors inspired investor confidence in India’s development prospects. In light of the recent decline in inflation, there was also optimism surrounding the likelihood of a positive revision to the RBI’s inflation forecast during the MPC. However, market sentiment was subdued as a result of the Reserve Bank of India’s decision to refrain from cutting its inflation forecast significantly, according to Vinod Nair, head of research at Geojit Financial Services.

“The central bank cited concerns over geopolitical unpredictability, the potential impact of El Nino, and the increase in the minimum support price, while reiterating their commitment to bring inflation close to the 4 percent target.”

“Market participants are anxiously awaiting the release of domestic inflation data for May, which is expected to show a decrease from the current rate of 4.7%. Investors will closely monitor the outcomes of the FOMC meeting and the US inflation print2 to determine the market trajectory, he added.

The Nifty Capital Goods index increased by 5%, the Power index by 3.3%, and the Auto index by 1.5%. In contrast, the Information Technology index decreased by 2.5% and the FMCG index decreased by 1%.

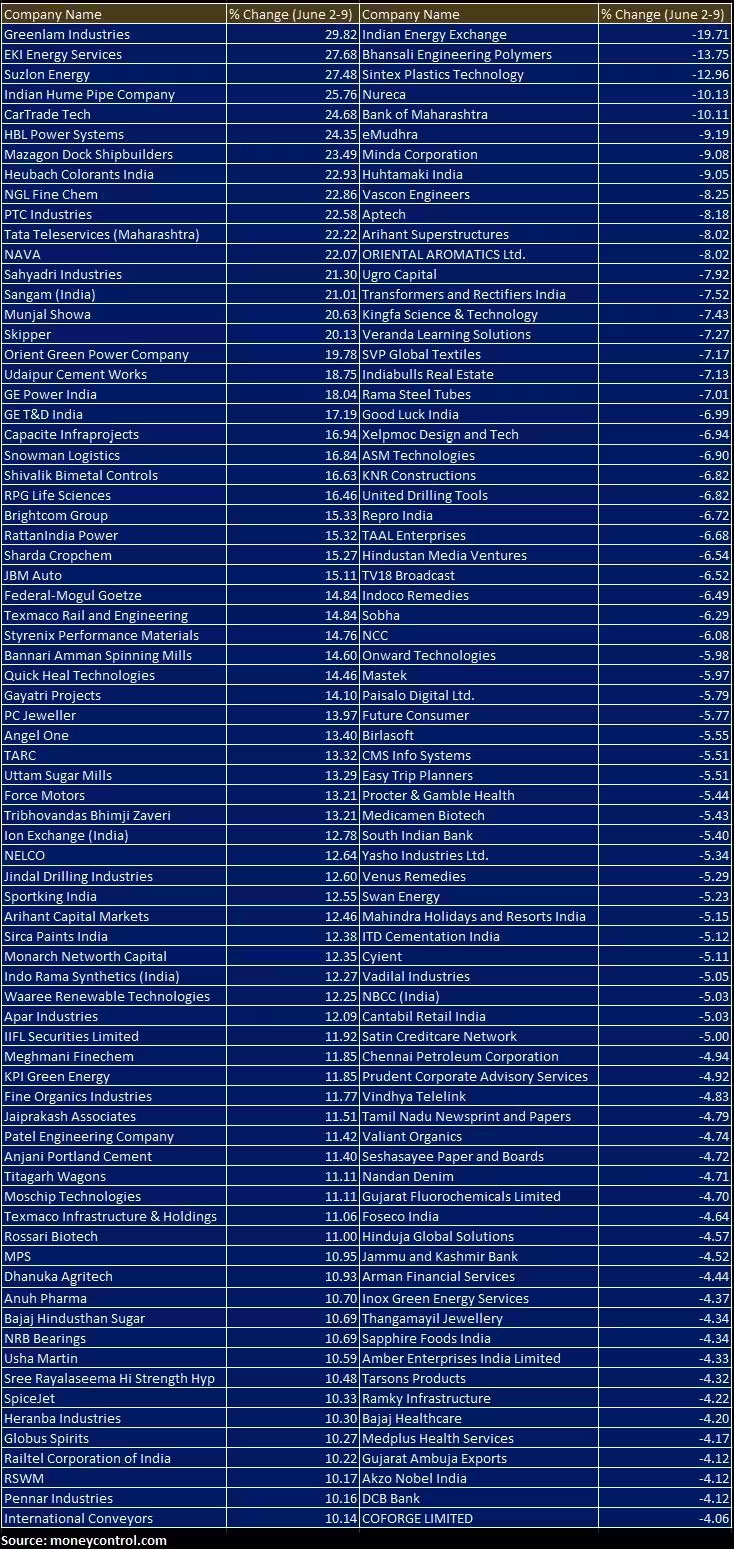

The BSE Small-cap index increased by 1.6%, led by Greenlam Industries, EKI Energy Services, Suzlon Energy, Indian Hume Pipe Company, CarTrade Tech, HBL Power Systems, Mazagon Dock Shipbuilders, and Heubach Colour India.

In contrast, shares of Indian Energy Exchange, Bhansali Engineering Polymers, Sintex Plastics Technology, Nureca, and Bank of Maharashtra fell by 10 to 20%.

Foreign institutional investors (FIIs) purchased shares in the amount of Rs 970.73 crore, while domestic institutional investors (DIIs) purchased shares in the amount of Rs 1,937.6 crore.

Where will Nifty50 go?

Amol Athawale, Vice-President of Technical Research for Kotak Securities

The focus will now shift to next week’s US FOMC meeting, with concerns over the Fed’s probable hawkish stance causing local investors to adopt a cautious stance. The Nifty encountered technical resistance near 18775 and reversed abruptly.

The index has formed a Hammer candlestick pattern on weekly charts, indicating further weakness from current levels. As long as the index is trading below 18675, bearish sentiment is likely to persist, and a decline to the 20-day SMA (Simple Moving Average) or 18450 is possible.

Further declines are possible, which could push the index to 18,350. In contrast, a new uptrend rally is conceivable only after 18,675 is surpassed, and above that level, the market could rally until 18800-18900.

Ajit Mishra, Senior Vice President of Technical Research at Religare Broking

On June 14, all eyes will be on the Federal Reserve’s monetary policy decision for hints. The European Central Bank (ECB) and Bank of Japan will also announce their policy decisions in the subsequent sessions. Participants will monitor IIP data, CPI Inflation, and WPI Inflation during the week on the macroeconomic front. In addition to these factors, they will continue to monitor the monsoon’s progression.

The last two weeks’ movement of the benchmark index demonstrates participants’ indecision near the record high, which is likely to end shortly. We recommend maintaining a positive stance until the Nifty sustains 18,400 and focusing on sectors with comparably higher strength, such as auto, FMCG, and real estate, while picking selectively among others.

In case of a decline, the region between 18,100 and 18,200 would provide the necessary cushion. We believe the current outperformance of the broad indices may persist, so we will continue to invest in quality midcap and smallcap stocks.